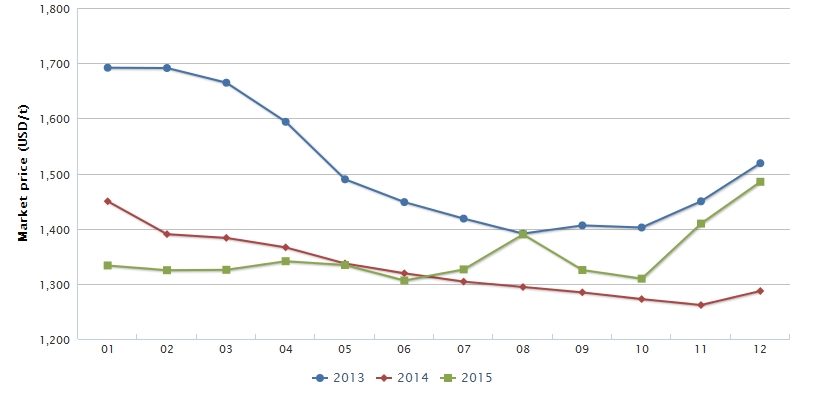

Since Nov. 2015, China’s market price of corn oil has

started to rise mainly attributed to the tension supply of raw material and the

coming sales season. Meantime, since the price of competing product is

predicted to be low in H1 2016, corn oil market is not optimistic in later

period.

Since Nov. 2015, the market price of corn oil has kept increasing and now hits

a record high of 2015. According to CCM, on 23 Dec., the average market price

of top-grade corn oil was USD1,485/t (RMB9,500/t), up 9.19% month on month, a

largest rise in 2015.

It is disclosed that there are two major reasons for the price surge.

- Rising price of raw material

The tight supply of corn germ (raw material of corn oil) leads to rising

purchase price.

Firstly, at present, prices of many deep-processed products of corn remain at

relatively low levels. Coupled with the weak downstream demand, manufacturers

have low motivation in production, resulting in low output of byproduct corn

germ.

Secondly, as the Chinese Spring Festival comes, corn oil market is going to

usher the sales season. Corn oil manufacturers start to purchase corn germ,

causing to tight supply.

Thirdly, the main producing regions of corn - North China suffered from snow

weather in Nov., which hindered the logistics and delayed the delivery speed.

As a result, China’s corn germ market has been in tension supply since Nov. And

the market price also bounced back in the early of Nov. Take Shandong Province,

major producing areas of corn germ as an example, since the early of Nov., the

mainstream corn germ manufacturers in Shandong up-regulated the ex-works price

for two consecutive weeks. The price rose by about USD23.45/t-USD31.26/t

(RMB150/t-RMB200/t), a growth rate of about 5%. At present, the mainstream

quotation reaches USD547.11/t (RMB3,500/t). The rising cost of raw material

spurs up the corn oil price.

- Coming sales season

Chinese Spring Festival comes and the weather gets cold in the fourth quarter

of a year. At this time, the market demand for edible oil will increase and the

corn oil market will meet the sales season. The rising sales volume of corn oil

will boost the market price to some extent.

China's market price of top-grade corn oil

in Jan. 2013-Dec. 2015

Source: CCM

However, the corn oil market is not optimistic in later period.

Although China’s 3 largest corn oil producers (Xiwang Foodstuffs Co., Ltd. -

Xiwang Foodstuffs, Changshouhua Food Company Linited and Fufeng Group Co.,

Ltd.) all perform well currently, their profit growth points are from the gross

profit of small packing corn oil. The overall sales volume of corn oil has been

declining. In 2013, Xiwang Foodstuffs’s sales volume of corn oil was 182,800

tonnes, while the figure dropped to 145,400 tonnes in 2014, a drop of 20.45%.

What’s worse, the market is likely to deteriorate further in 2016 mainly

affected by the competing products - soybean oil and rapeseed oil.

- Soybean oil

Over 80% of soybean in Chinese market is

imported, among which over 80% comes from Brazil and Argentina.

Brazil: The devaluation of Brazilian Real

lowers the cost of imported soybean from Brazil

Argentina: On 17 Dec., the Government of

Argentina announced to loosen it control on the currency of peso. Expert

claimed that this move would lead to devaluation of the peso. Additionally,

President Mauricio Macri signed a decree to reduce the export tariff of soybean

from 35% to 30%

Above positive policies will boost the exports of soybean in South America. In

H1 2016, China’s sufficient supply of soybean is expected to pull down the

market price of soybean oil.

- Rapeseed oil

Since China’s sales of nationally-stored rapeseed oil were in depression in H1

2015, the current inventory is large. According to the Chinagrain.cn, the

current inventory of rapeseed oil is about 5.80 million tonnes in China,

including 400,000 tonnes and 800,000 tonnes that were purchased in 2009 and

2010 respectively. Pressured by the high inventory, it is forecasted that the

rapeseed oil price will still maintain at low level.

Therefore, the limited market space of corn oil will be squeezed further by the

competing product market with low price in H1 2016.

About

CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta.

We will attend FIC in the coming week. If you would like to meet us for consultancy in FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.